3 "Stealth Taxes" that Increase Your Tax Bill Without You Knowing

Stealth Tax #1 - Bracket Creep

Most taxes in the tax code are adjusted for inflation.

For instance, in the past, the federal income tax brackets have always been adjusted for inflation. If inflation rises 2%, tax brackets are adjusted 2% higher. This makes sense. Otherwise, over time, we would all be pushed into higher tax brackets due to nothing other than inflation.

Well, in 2017, as part of the Tax Cuts and Jobs Act, there was a critical change made. Many of you likely missed it with everything else in the bill.

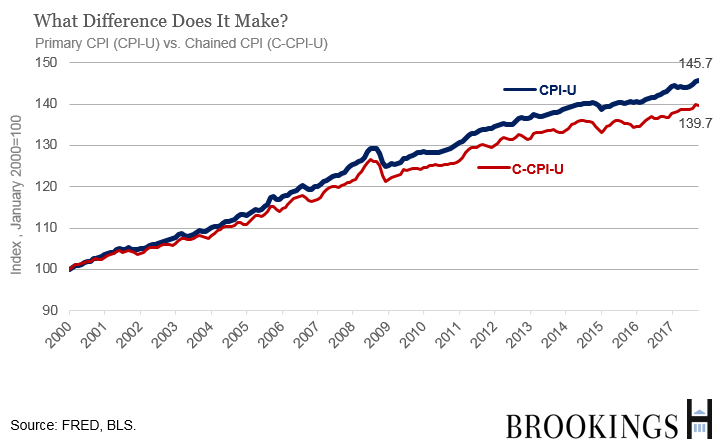

Congress changed the way tax brackets adjusted for inflation.

They changed from the standard measurement of inflation CPI to something called a Chained-CPI. This seemingly small change will have massive implications over the long term.

From 2000- 2018, this Chained-CPI adjustment would have resulted in tax brackets receiving a 13% reduction in the amount tax brackets adjusted to inflation.

What does this mean?

Your taxes in the future are going to be higher than you previously thought.

Stealth Tax #2 - The Social Security Tax Trap

The tax trap (or tax torpedo) can be one of the single most confusing parts of Social Security.

We've discussed it on this blog in the past - click here to read that post.

Most retirees don't know that when they enter retirement, they enter into a different tax system than when they were working. This is because of how Social Security is taxed.

Let's explain with an example.

We have a couple who is filling their income needs with Social Security (total benefits = $40,000) and withdrawals from their IRAs (amount = $40,000).

Based on Social Security taxation guidelines, up to 85% of their benefit would is taxable. Based on their taxable income*, they will be in the 12% tax bracket.

Quiz time, if they decide to go on a family vacation this year and decide to pull an additional $1,000 from their IRAs, what tax rate would they be taxed at?

If you said 12%, you'd be wrong. Because of Stealth Tax #2, their actual tax rate would be 22.2%.

Here's how:

- Because of the additional $1,000 withdrawal, taxable income goes up by $1,000.

- Because of the additional $1,000 withdrawal, an additional $850 of Social Security Benefits becomes taxable

- At the 12% rate, taxes on $1,850 are $222

- The "Tax Cost" of the extra $1,000 withdrawal is $222 or 22.2%

This tax trap can not be understated enough. At its peak, it can cause you to pay 40.7% in taxes when you think you're only paying 22%. It can cost the average retiree up to $5,000 a year in extra taxes!

*For simplicity sake, I do not include deductions in this example

Stealth Tax #3 - The 3.8% Obamacare Surtax

This stealth tax is critical for retirees with taxable accounts or retirees selling large amounts of real estate.

In 2010 as part of the Affordable Care Act, a tax was levied on capital gains for investors that were deemed "too wealthy".

Normally capital gains rates are either 0%, 15%, or 20% depending on where your taxable income falls. The Obamacare Surtax adds 3.8% to this in certain cases.

This brings the actual capital gains rates to 0%, 15%, 18.8%, or 23.8%.

For individuals, this tax is levied if taxable income rises over $200,000, for couples, this tax is levied at $250,000. Notice how the income threshold is significantly less ($200,000 vs. $250,000) for married folks. This surtax also can greatly affect dividend income!

The existence of this tax can be described as a Stealth Tax but it really becomes apparent this is a hidden tax when I tell you the threshold amounts for this tax haven't been adjusted since its inception!

So whether they know it or not, every taxpayer is drifting closer and closer to being affected by this added tax.

- - - - - - - - - - - - - - - - - - -

Each of these stealth taxes presents a different problem for retirees. Especially when you think about trying to prevent them. Does saving on taxes this year, raise my taxes next year and down the road? Or vice versa?

We've always pounded the importance of a Forward-Looking Tax Plan. This is more important now more than ever before with:

- A skyrocketing national debt becoming out of control

- Congress seemingly adding more of these "Stealth Taxes" to the tax code

- COVID-19 stimulus effort quickly adding trillions to the national debt

No matter which way you slice it, all signs point to higher taxes in the future. Are you prepared?

Always remember:

You Don't Need More Money. You Need a Better Plan.