File at 62 vs. Delay: At What Age Do I Break Even on Social Security?

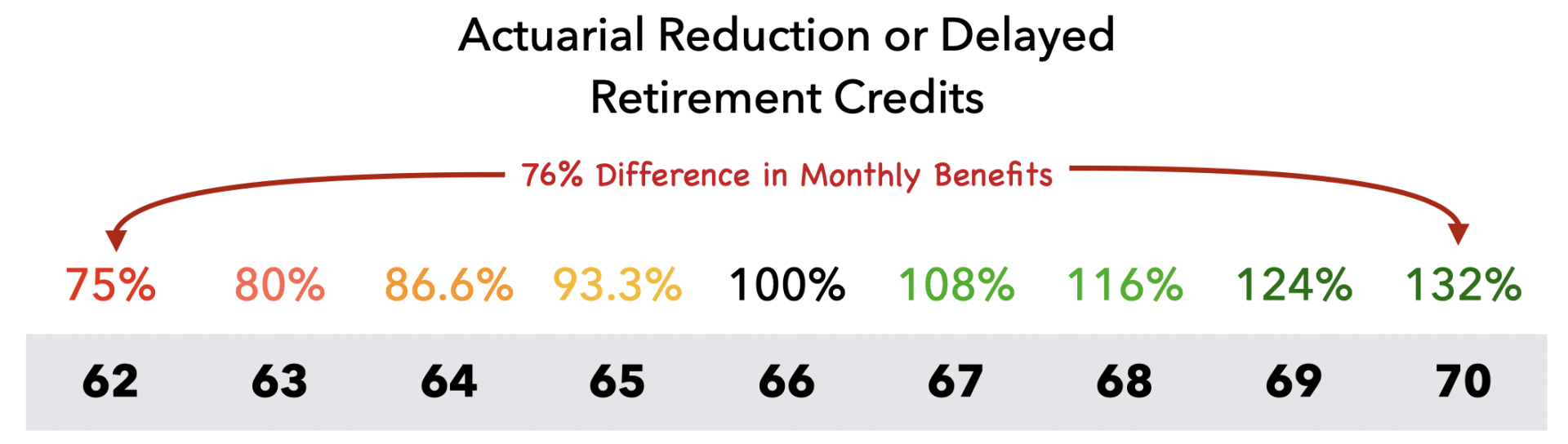

Wow, a 76% difference in your monthly paycheck! If your benefit at 62 is $1,500 a month, at 70 it would be $2,640! So although you're missing out on those 96 months of monthly paychecks, your benefit will be significantly higher.

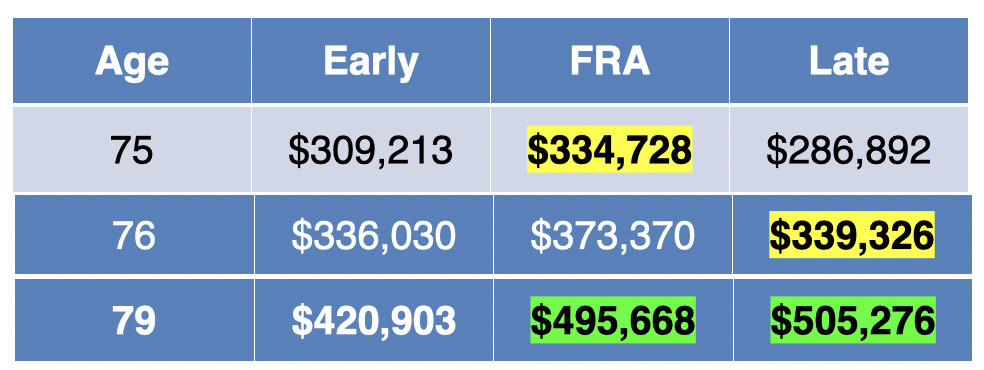

So, at what age do you breakeven? The answer, 79.

Age 79 is the first year in which delaying to 70 becomes your highest lifetime benefit value choice. That is when we plan for Social Security in a box, without considering your other assets. Your breakeven age is typically younger when we factor in taxes, Medicare decisions, withdrawal strategy and other key coordinating decisions.

But let's keep this analysis simple for now.

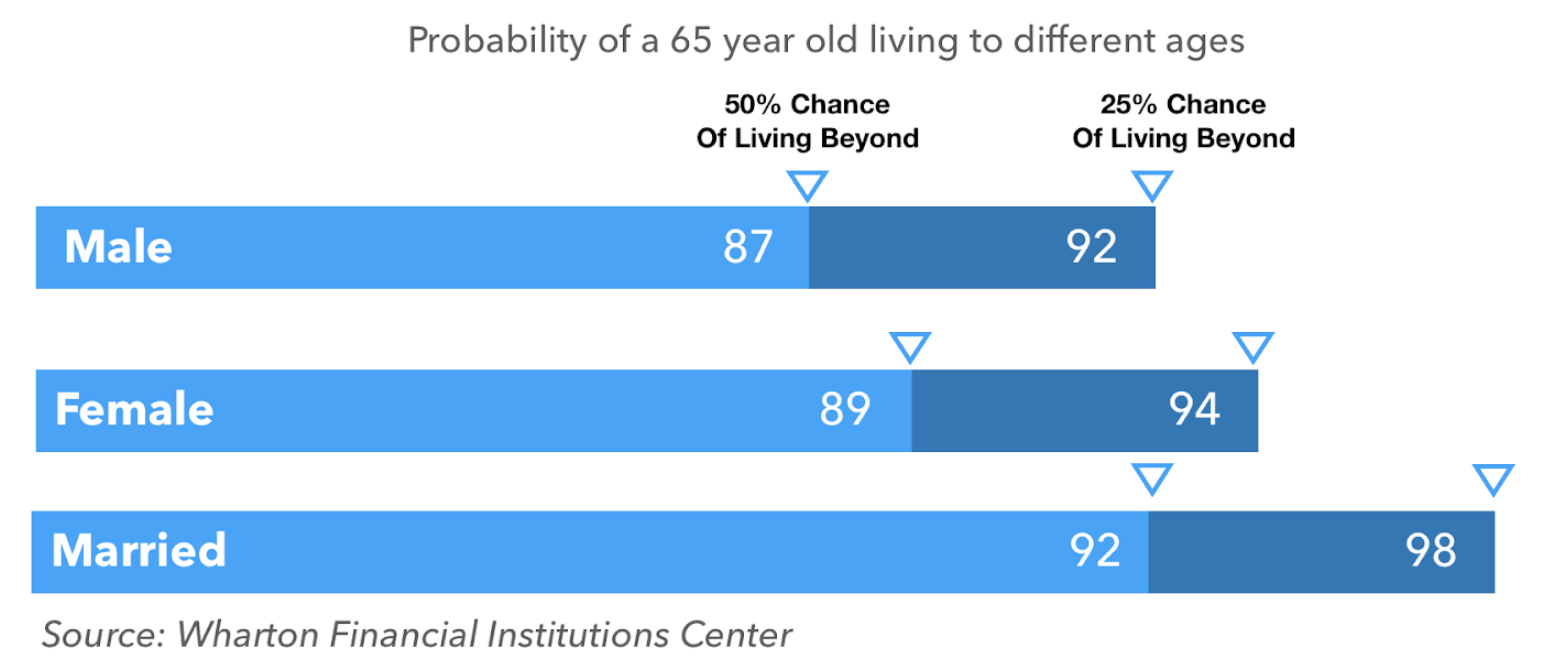

What is the likelihood that you live beyond age 79? Very good.

Statistically speaking, everyone reading this article has a 50% or better chance of living beyond 79. In fact, if you are 65 years old, your life expectancy might be much longer than you think.

The average 65-year-old male has a 50% chance of living beyond 87. A female has a 50% chance of living beyond 89. If you're married, there is a 50% chance one of you will live to 92 and a 25% chance one of you will live to 98!

Speaking of married couples, you may want to consider one more variable when calculating your breakeven age...

The Importance of Considering Spousal Survivorship Benefits

When talking with retirees (particularly men), an objection I hear is, "I've got a heart issue or high blood pressure or [insert health condition], there is no way I'm making it past 79."

When deciding on when to file for Social Security benefits, it's not all about you; it's about your spouse too.

Let me give you a quick example of a fictional man named Dan. Dan was born in 1955 and is 65 years old. He owned a plumbing business for 40 years and made roughly $84,000 a year. His Social Security benefit at each age is:

- 62 - $1,539/mo - $18,468 per year

- Full Retirement Age - $2,467/mo - $29,604 per year

- 70 - $3,724/mo - $44,688 per year

*These numbers and the numbers to follow are inflation-adjusted according to the SSA guidelines

Between these filing ages, when does Dan break even?

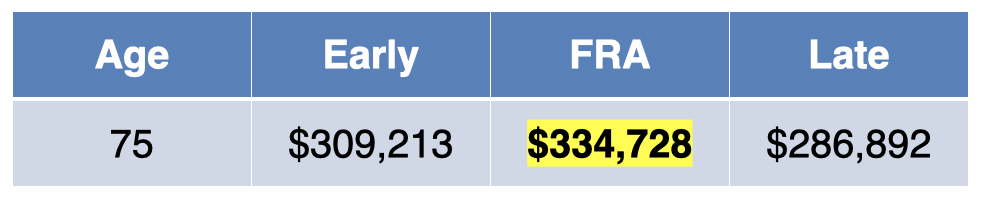

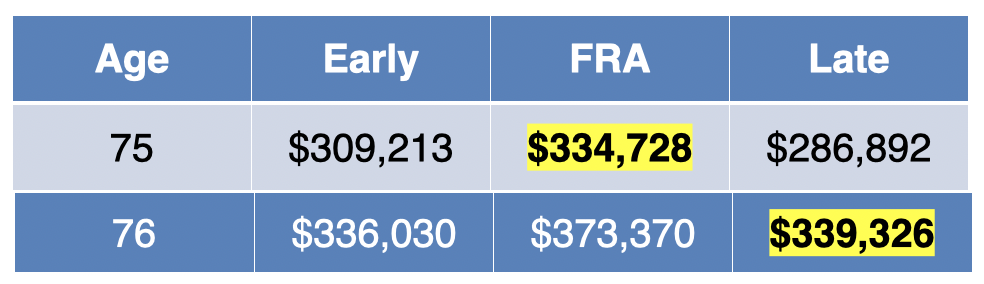

Age 75 is the first year Dan would be better off filing at his Full Retirement Age (age 66 + 2 months).

The following year, age 76, is the first year that delaying to 70 overcomes the total benefit value of taking at 62. However, taking at Full Retirement Age is the winner.

As we discussed above, age 79 is the breakeven age when delaying to 70 becomes the optimal choice.

At the beginning of this section, however, we touched on survivorship benefits. Well, Dan is married to his high school sweetheart Diane. Dan was originally going to file at 62 and be done with it until we showed up how big of a disservice it would be to Diane.

If you married, at the death of a spouse, you can continue to take your benefit or switch to the higher of the two benefits. These are called survivorship benefits.

Dan was the breadwinner of the house and we had Dan take a longevity quiz to get an idea of his life expectancy. He has a mild heart condition that lowered his life expectancy to 84. We showed the table below to Dan that instantly made him decide to delay to 70.

One of the single most important things we hear from married retirees is, "If I pass away, I want to make sure my spouse never has to worry about running out of money."

Well, the #1 way to accomplish this is with Social Security.

At Dan's passing at 84, if he took Social Security at 62, only $33,187 would pass on to Diane. If he delayed to 70, almost double would pass on to Diane, nearly $65,000 per year!

--------------------------------------------

These are just 2 of the 15 critical factors you must consider before deciding when to file for Social Security. Did this article make you pause and rethink your filing strategy?

Want to learn about the other 13 factors and how they may prevent you from making a costly Social Security mistake?