Planning "Alpha"

What is Planning "Alpha"?

"Alpha" in finance is a term used to measure outperformance.

Almost everyone in the industry focuses on Alpha compared from one investment to the other. In fact, you've probably attended a dinner presentation or two where the speaker talks for 2 hours about how his investment outperforms another investment.

Investing is extremely important to a sound retirement, but most advisors are missing the mark when talking about "Alpha" and outperformance.

Focusing solely on investing performance is the equivalent of a football team only concentrating on kicking the ball through the uprights. What about scoring touchdowns, defense, passing, blocking, etc.?

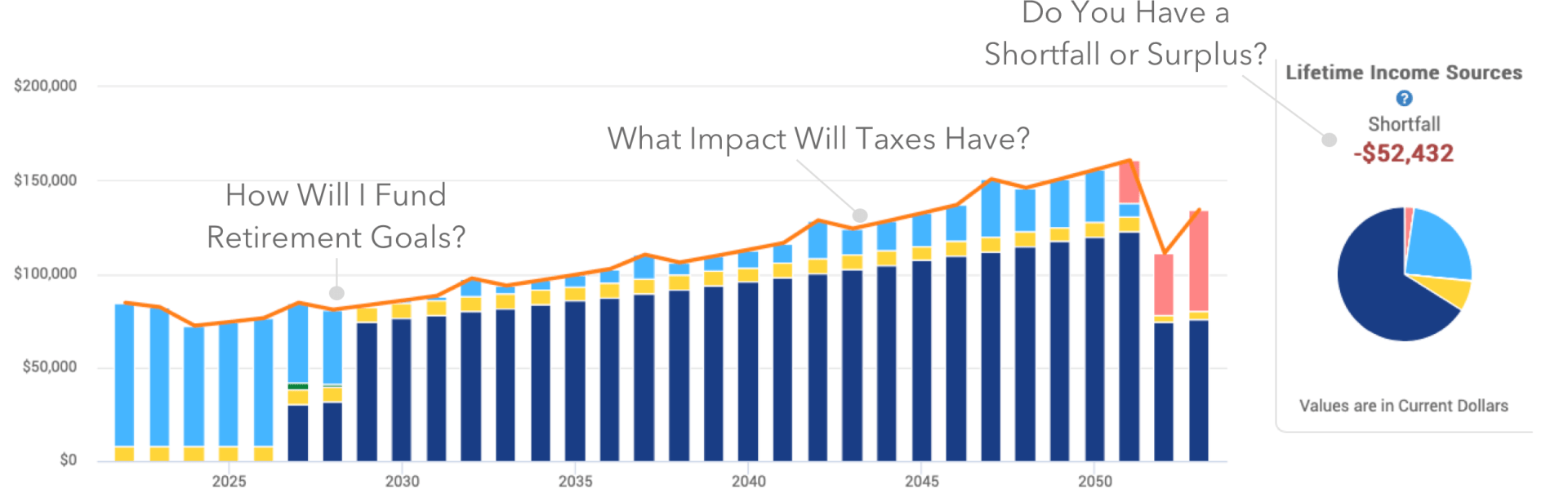

We believe the most critical, (and more importantly) the most attainable Alpha comes in the form of what we call Planning Alpha.

Optimizing your Social Security benefit can increase lifetime benefits by upwards of 50%. A dollar saved on taxes is equivalent to a dollar made on your investments, yet the latter typically means taking more risk. Withdrawing from the right accounts at the right time can increase the longevity of your nest egg by years!

So what is the actual value of "Planning Alpha"? The only accurate way to measure is to see the value it can have for your situation. However, as a benchmark, Vanguard released a study in 2018 showing the value of proper planning to be upwards of 3% per year for a retiree. What investment can stack up to that?