Transparent Pricing

Could you imagine going to the grocery store and rather than a price tag by each item of food, there was a sign that said, "See Grocery Clerk for Pricing". Imagine shopping on Amazon.com and every item you searched for said, "Call 1-(800) 555-5555 for Pricing Information".

Something tells us neither of those businesses would last very long...

And yet, if you were searching for a local advisor to help you plan for retirement, how much luck do you think you'd have finding their pricing? For some reason, we've all accepted not knowing what we are really paying for financial advice.

We've accepted the fees and costs we are actually

paying are nearly impossible to calculate.

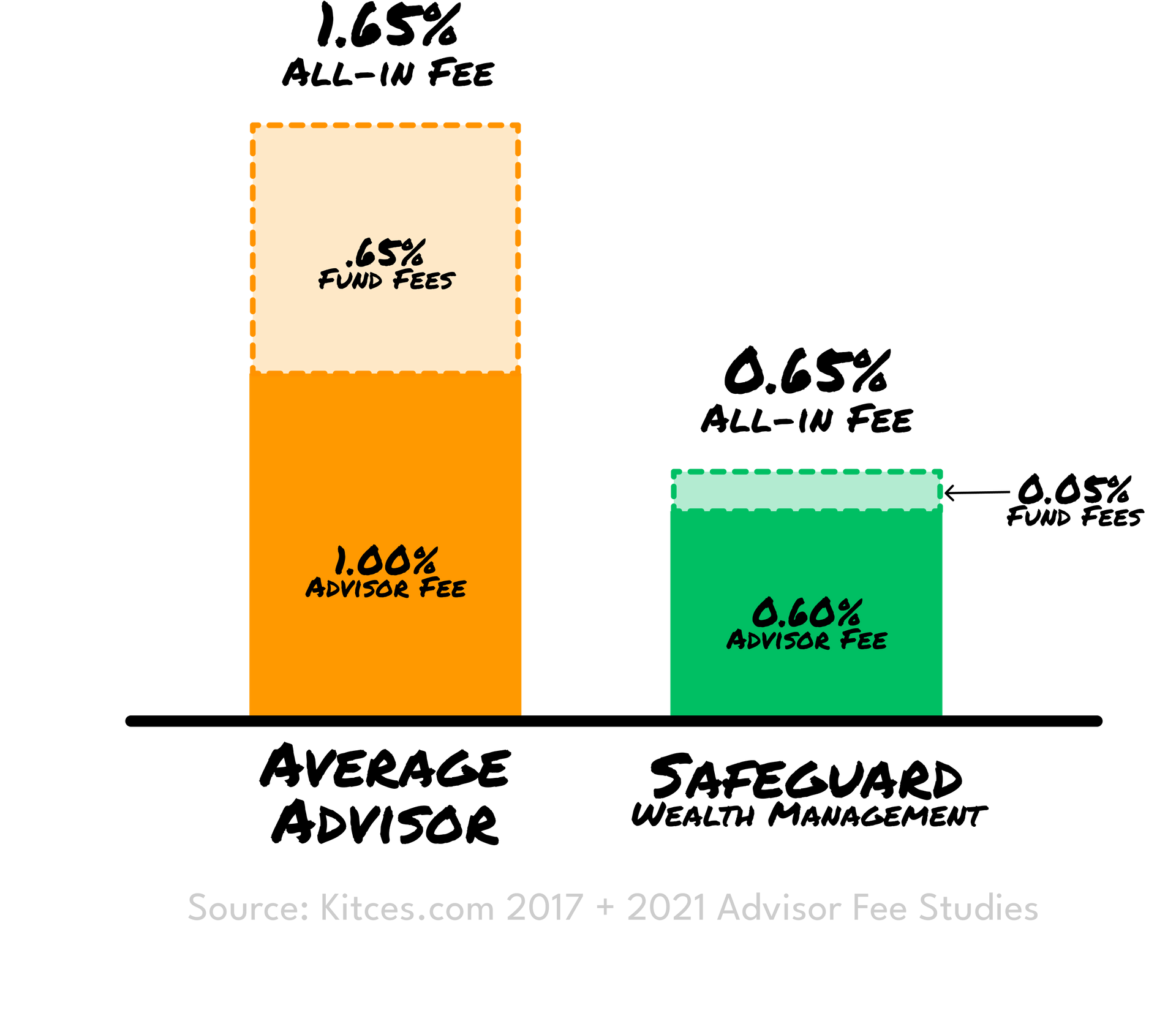

At Safeguard Wealth Management, we have no reservations about putting our prices front and center. In fact, we're very proud of the value offer we make to clients. Our all-in fees are a fraction of the national average.

And yet, through leveraging technology, we are able to deliver advanced, coordinated retirement plans to our clients.

Fees Are Only Part of the Equation

Low Fees are Important. Value from Those Is More Important.