WHAT'S NEW?

"If I delay my Social Security benefit, at what age would I breakeven versus simply filing at 62?" We field this type of question frequently from retirees. The Social Security system allows you to file anytime between 62 and age 70. At first glance, filing at 62 seems to make the most sense. After all, there are 12 months in a year and eight years between ages 62 and 70—That's 96 months of monthly paychecks that you wouldn't be getting if you delayed. However, you get penalized for taking your benefit early. Below is a diagram showing the penalties and delayed credits for someone whose Full Retirement Age is 66:

Lately I’ve been getting asked how I was able to “Call the Bottom” in late March. I want to make something clear: I didn’t. If you go back and look at the article from March 16th or read the email I sent out to subscribers on the 26th, (pure dumb luck), I ran a bad case, a best case, and a base case valuation on the S&P 500. I arrived at a base case valuation of 2,950, and at the time the S&P was hovering around 2,300, so we started recommending clients initiate buying plans. These plans did not mean “This is the bottom” or “Go all in.” Far from it. Many of our clients were buying several days before the precise bottom, and several days and weeks after. Regardless of how clearly I try to make this point (that we simply were buying something the math said was likely cheap) this morning my inbox is chock full of people asking what I think about valuations now. Are we in a bubble? Is the market ahead of the fundamentals? Are we going to double dip? Will the market crash? Will we need a second stimulus? Maybe. I have no idea. Here’s what I know, when you accumulate all of the available earnings estimates and make a conservative estimate of fair value, you end up with a fair value of about 3,060 on the S&P 500. As I type this we sit at 3,080. Regardless of whether the number is 2,950 or 3,060 or 3,080 or 3,150, any way you slice it, we’re at fair value, now. Analyst Earnings Estimates:

It is your right as an American to (legally) pay the least amount in taxes that you owe—nothing more, nothing less. But in recent years, Congress has made a concerted effort to shift the IRS code and levy you with taxes you didn't even know you were paying. We call these "Stealth Taxes." These changes are never talked about by your congressman (or woman). They lie deep within the tax code and can potentially cost you significantly unless you learn about how to avoid them. In this article, we cover three of those "Stealth Taxes" and what you can do to minimize or avoid them altogether.

Greenwich, CT. May 2008. Feels like forever ago. Another life. Hard to believe it was just over a decade ago. My first “Real” job. Analyst for S.N. Phelps & Co., a firm that managed money for a bunch of insurance companies. In the open office environment, my boss, the firm’s proprietor, the late Stanford Phelps, sat directly across the desk from me. After exchanging pleasantries and sipping my coffee, Stan asked me a question: “What assets are risk free?” As with all of his questions, it was a test, a teaching moment and a trap, all rolled into one. I knew the academic answer of U.S. Treasuries wouldn’t cut it, here. My mind raced. I knew Stan was a well known student of George Patton and demanded fast answers, even if incorrect. “There aren’t any.” I answered, praying for my job. Thankfully I had a month-to-month lease. Please don’t fire me. Please don’t fire me. Please don’t fire me. He smiled “That’s an ok answer…” I exhaled. “But there’s a better one,” Stan continued, “EVERY asset is risk-free IF you buy it cheap enough. This building. If I bought it for a nickel, is there really any way I lose money on it? Even if I do, I lose a nickel. If I buy Manhattan for a buck, can that really hurt me?” “No.” I answered. “Even if it goes up and down in value 95% every day, it doesn’t matter.” Stan smiled and pounded the desk with glee, “That’s exactly right!” Will I make the case that stocks are risk-free at these levels? No. Definitely not. However, there is a price where they are so cheap that it’s difficult to lose. Is that level 20,000 on the Dow? No. But some individual names are already getting down to the point where someone beginning a buying plan from these levels that can stick it out for a few years is going to make generational wealth. “Buys of a lifetime.” According to Kyle Bass’s recent CNBC interview where he exclaimed “You can be a value buyer again!” This concept of price and risk can also work against you. Return-free risk. If you paid $1 Trillion ($1,000,000,000,000) for the device you’re reading this article on, there’s realistically a 100% chance you lose all the money. I would argue we’re seeing this in the market right now, in the form of bonds. As I type this, the 10 year Treasury is paying 0.63%. An investor buying a 10 year Treasury today is paying 158x earnings for an asset that can’t grow earnings for 10 years. If you own bonds today... Why? So-called “Safety” is ludicrously over-priced at these levels. How dangerous is a stalwart like Clorox (CLX)? The chart would say it’s not nearly as dangerous as the rest of the market, holding up well the last few weeks. You “only” have to pay 27x earnings and collect a 2.42% dividend, essentially 4x as good of a value as bonds. Not cheap enough? Diageo, one of the largest liquor distillers in the world, is currently at 19x trailing earnings. Put differently, Diageo, a large, stable, growing business, has an earnings yield over 5%. Why accept 0.86%? Not cheap enough? Let’s get real crazy. The Dow Jones Industrial Average is trading at 17x earnings. That’s a 5.9% earnings yield. Is more trouble ahead? Yes. Will some of them fall to zero? Yes. Is the bottom in? Who knows. (probably not.) All I know is if you can wait 10 years, I’ll take 5.9% over 0.63% every time.

Due to everything going on with the Coronavirus and financial markets, the spectrum of questions we are fielding right now is broad. From: "Should I be taking all of my money out of the market right now? It seems like this could get a lot worse!" To: "I have had cash on the sideline in case of a crash, are stocks cheap? Should I deploy that money and get back into the market?" And on a grander scale: "What does this mean for my retirement? Does my plan change?" From a valuation standpoint, Tony wrote an excellent article showing what we should expect over the intermediate to long term. Click here to read it . In this article, I am going to explore each of the questions above and talk you through different ways to plan for the Coronavirus impact. I don't mean a plan from a health standpoint; I'll leave that up to the doctors (and those who are playing doctors on Facebook) A Plan For Coronavirus I cannot say this enough; the worst plan is having no plan. The second worse plan is an irrational one. One based on emotion, rumors heard from co-workers, Facebook friends, or a plan driven by fear. Question 1: "Should I get out of the stock market completely?" Step back from the Coronavirus pandemic completely. In the worst-case scenario, this will be a national tragedy. I don't want to downplay that in any way. Tragedies are real, and they will be felt close to home if it gets to that point. However, as bad as the Coronavirus is, it is temporary. The social distancing and quarantining will cease at some point in the future. When? That is yet to be determined. But life will return to normal. That also means the economy and stock market will return to normal as well. No one, and I mean no one, knows when we will see the stock market "bottom". Maybe it has already happened, or perhaps the market will fall to -50%. If we map out all the possibilities, statistically, you have already felt most of the pain. Which means it would be unwise to exit now. Exiting the stock market now opens the flood gates for questions: Are you going to take everything out of the market or just a portion? How will you determine? When will you invest back in? Will you try to invest back in when things get cheaper? When is cheap enough? If it never does, are you just going to sit on the sidelines? Will you try to invest when things rebound? What is your definition of rebound? What if it rebounds and turns lower? Will you buy and hold from there or sell? Have you thought through all the potential scenarios from here? Separate and identify where the emotion to sell is coming from. Did you see all the toilet paper and rice sold out at the local Costco or Walmart? Did that send you into thinking this is the start of a mini-apocalypse? Separate fact from feeling. What are the facts? Why are you exiting anyway? If you were taking too much risk before this all, then so be it. We can't go back in time. Learn from it and move forward. Now is not the time to exit, even if the stock market falls from here. Question 2: "Should I invest the cash I have had sitting on the sidelines right now?" The market is down; you have cash sitting on the sidelines, is now the time to deploy it? Statistically yes. Again, check out Tony's article to see a fundamental analysis of where the market is. But there are a few other things to consider. Are you going to lump-sum (all at once) or periodically invest that money? Most investors don't have the stomach for a lump sum. The market is "cheap" right now, but it can go down further and become cheaper. Panic increases exponentially with every -1% drop. For example, let's say you lump summed that money right now. A week from now, the market improves by +10% from right now. You're feeling pretty smart. The market reverses and falls by -20% (-10% from here. Approx. -40% overall.) You go from feeling brilliant to feeling like an idiot (don't worry, you're not). Every radio show, news program, social media post, etc. is about how bad this all is going to get. Do you have the stomach to sit through that all? We advise a more caution-first approach. Use a concept called Dollar Cost Averaging to your benefit. But have a plan. For instance, the plan might be: Today, I am going to invest 20% of my cash. Every -5% drop from here, I am going to invest 10% more into the market. Here's what this looks like if the market keeps falling:

The Dow Jones Industrial Average is currently down 2,769 points, at 20,416 down nearly 30% from the all-time high. A common thought we’re hearing from investors is “I’m done. The market just killed my retirement. I have to work longer. I don’t have any more money to save…” Many investors have a MASSIVELY overpriced asset in their portfolio and just don’t know it. Bonds. If you own bonds today...congratulations. If you plan to own them going forward, WHY? The Bond Risk/Return Ratio We are at all-time lows in rates. The most likely scenario is that a bond bear market is ahead of us. The last time we had sustained rising rates, bonds lost 60% of the wealth invested in them! Barclay's Aggregate Bond Index (a combination of long and short term bonds) is currently yielding 1.82%. According to the U.S. Bureau of Labor Statistics, 12-month inflation is 2.30%. We don't need a calculator to know that's a losing proposition. If you're paying an advisor, paying taxes, or have any other investment-related fees, this pushes your bond yield further into the red . 10-year treasuries are now yielding 0.76% Think about that for a moment. Someone buying a 10-year bond right now is willing to pay 131 times earnings for an asset that they know can’t grow earnings for 10 years. Interest rates are at all-time lows. As they rise, bonds lose money. Looking forward here is what we can expect from interest rates:

The Coronavirus is continuing to lead news headlines throughout this week as it grows in size, and we are gaining more data on it. Global financial markets around the world have been rocked by COVID-19. During times like these where we can physically see an increase in panic and fear in our daily lives, we often lose sight of the opportunities around us . In fact, during volatile periods like this, there are substantially more opportunities to take advantage than during calmer times. In this quick article, we share with you four retirement opportunities that the Coronavirus has indirectly created for you. 1. Refinancing Your Mortgage and Other Debt Interest rates have been plummeting during the past couple of weeks. The 10-year Treasury began the year at 1.90% and has fallen to as low as 0.32%! This drop has been unprecedented in such a short time. This opens up a significant opportunity for those carrying a mortgage or other debt. No one knows where interest rates are going from here. Maybe they will fall lower, and the case for a refinance will only get stronger. However, we are at all-time lows on the 10-year. For nearly everyone reading this article, refinancing now will translate to an apparent savings. If you have been thinking about refinancing, we would recommend moving quickly. Tony and I both are refinancing our mortgages. We "locked-in" our rates one day apart. Tony locked his rate in at 2.75%, the next day I was at 3.25%*! * Both on a 30-year mortgage 2. Dump Inflation Losing Assets Before interest rates began plummeting, retirees were facing a low-yield investment world. After these rate drops, retirees are facing a really low-yield environment. The good news? If you owned bonds the past few weeks, this part of your portfolio has done exceptionally well. As interest rates fall, bond prices go up. This is why bonds have looked so attractive over the past 30 years. The bad news? As interest rates rise, bond prices go down. This bond bull market is likely ending. We are at all-time lows in rates. Probabilistically, a bond bear market is ahead of us. The last time we had a bond bear market, bonds had a real (inflation-adjusted) drawdown of -60%!

Around the world, millions of investors are losing sleep over COVID-19, the “Coronavirus.” Should I be moving to cash? Is this going to spark a recession? Is the market going to crash? Should I sell out of my Chinese funds? Should I hide in bonds? Is my retirement going to be ok? In my experience as a financial advisor, I’ve seen investors go through these periods (Grexit, Ebola, Brexit, etc.) every few years, and get so wrapped up in details coming from newsrooms that they lose the bigger picture: If your plan needs to “react” or “respond” to a 10% pullback...You don’t have a plan. Events like this that send the stock market spiraling downward don't create more risk in your retirement plan. They uncover the risk that is already there. A real plan: Does not depend on a bull market to “make” your retirement. Does not depend on the outcome of an election. Does not need to adjust based on routine 10% corrections in the stock market. Does not depend on any “market wizard’s” ability to time anything. Fits your personality. Allows you to sleep comfortably, regardless of what the news is saying. A solid financial plan gives you the freedom to enjoy life . It doesn't rely exclusively on returns from the market. Those types of things are ultimately out of our control. Plans do not spontaneously create themselves. If the market gyrations are making you uncomfortable, you need to make your plan a priority. An expert can show you a better path. Do you have a plan? If you'd like to take the next step toward seeing the power a true retirement plan can have for you, click here and tell us a bit more about your situation .

Did you know that Americans hold more money in cash than the entire value of the New York Stock Exchange (NYSE)? We all invest in cash to some extent and for obvious reasons. We all keep a certain amount of money in our checking and savings accounts in order to pay ongoing and foreseeable expenses. In today's market environment, we often see retirees keeping higher levels of cash to "protect" against market losses. Statistically and historically, this has been a losing proposition, but we'll save that for another article. In this article, we are going to explore how not all cash is created equal and how, in this new era of low fees, companies are finding "hidden" ways to make money off you. Note: As a broad rule for cash and cash equivalents, given the same level of safety, an investor should be searching for the highest yield. For example, two banks offer FDIC insured money market funds. Bank A is at 0.25%, while Bank B offers a 1% rate. In this simple example, Bank B makes more sense to park your cash. The "Low-Interest" Fee In recent decades, the investment industry has seen fees across the board fall. You can now invest in index funds for <0.05% per year. Mutual fund costs have cut by 25% in the past two decades. Custodians like Charles Schwab and TD Ameritrade offer commission-free transactions. It has never been cheaper to invest your money! Or has it...? During this war on fees, companies and advisors are finding hidden ways to earn fees . One of those ways is through the yield on cash. For example, two weeks ago, we performed an investment audit for a prospective client. The client had roughly $40,000 in cash across various investment accounts. Their current advisor worked for a wirehouse firm (owned by a larger bank) and put that $40,000 in that bank's money market account. This low yielding cash account was earning 0.22% even though any reasonable money market account at the time is earning closer to 1% and above. Furthermore, the client was getting charged 1.20% per year on top of this! So why would this advisor put $40,000 of this client's money into a lower-yielding cash account? The bank was earning a higher interest rate on that money, paying the client a lower interest rate, and keeping the spread. Is this fiduciary ? Of course not. Yet it happens all the time. How big of an impact will this have on this particular retiree? From the start, this client was losing money. On that $40,000, they were earning 0.22% and paying their advisor 1.20%. Right off the bat, they were directly losing 1% per year. Not to mention the indirect costs. In 2019, inflation was 2.30%. Then the opportunity cost. They should be earning upwards of 1% on their cash. In total, they were losing 3.30% ($1,320) per year on that $40,000.

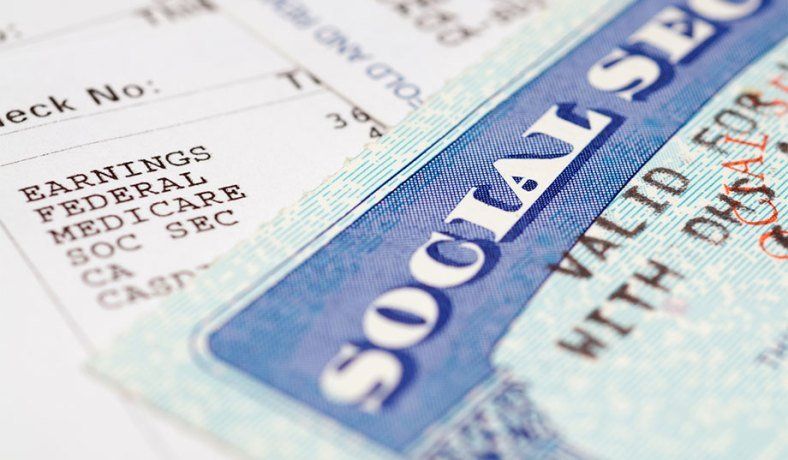

Do you know when Social Security was signed into law, the first pamphlet they gave to retirees said Social Security is not taxed and never will be? Well, hopefully, no one took congress at their word. A lot has changed since then, and now Social Security is taxed a few different ways. For simplicity's sake, we are going to talk about taxes in terms of a married couple (the numbers in this article will change slightly for an individual). Taxes on Social Security can get quite complicated. This article is a 1,000-foot overview of Social Security and its taxability. If you are interested in learning more about the gritty details of how Social Security is taxed, I'd recommend you attend our Maximizing Social Security cla ss es . The Tax Trap Impact The tax tables, while you are working and earning income from a job, are straightforward. We have a graded, marginal tax system where each dollar is taxed based on what bracket that dollar falls into. Below is the 2020 marginal tax bracket. We'll call it the Worker's Tax System: