Blog Layout

Viral Valuation

Tony Hellenbrand • March 16, 2020

The Dow Jones Industrial Average is currently down 2,769 points, at 20,416 down nearly 30% from the all-time high.

A common thought we’re hearing from investors is “I’m done. The market just killed my retirement. I have to work longer. I don’t have any more money to save…”

Many investors have a MASSIVELY overpriced asset in their portfolio and just don’t know it.

Bonds.

If you own bonds today...congratulations. If you plan to own them going forward, WHY?

The Bond Risk/Return Ratio

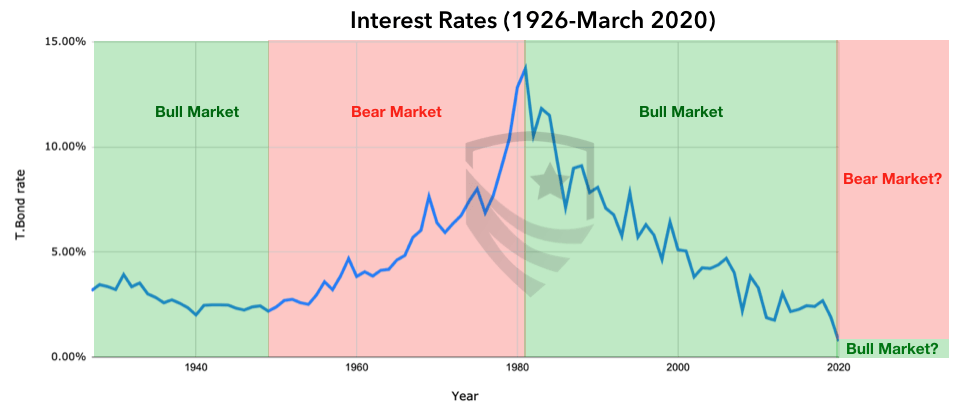

We are at all-time lows in rates. The most likely scenario is that a bond bear market is ahead of us. The last time we had sustained rising rates, bonds lost 60% of the wealth invested in them!

Barclay's Aggregate Bond Index (a combination of long and short term bonds) is currently yielding 1.82%. According to the U.S. Bureau of Labor Statistics, 12-month inflation is 2.30%. We don't need a calculator to know that's a losing proposition.

If you're paying an advisor, paying taxes, or have any other investment-related fees, this pushes your bond yield further into the red.

10-year treasuries are now yielding 0.76% Think about that for a moment. Someone buying a 10-year bond right now is willing to pay 131 times earnings for an asset that they know can’t grow earnings for 10 years.

Interest rates are at all-time lows. As they rise, bonds lose money. Looking forward here is what we can expect from interest rates:

If you’ve been sitting on cash and money markets for years afraid the market might crash, congratulations. If you still plan to sit on that cash for the foreseeable future...why? What are you waiting for? Stocks to be cheap?

“Cheap” Stocks

Valuing the stock market as a whole is a simple exercise. You need to know:

- The “Risk-Free” Rate

- Long term earnings growth rate

- Current earnings of the market as a whole (you know what it was)

- Long-term risk premium (how much “extra” return you get from stocks)

If you assume that the virus has not impacted the economy long-term (i.e. over the next 10 years) and that the long-term extra return you get from owning stocks is relatively stable, you can look up 10-year treasury rates, and bingo - you have 75% of the data needed to “value” the index.

You can then run various scenarios for earnings and see different “Fair Values” of the stock market as a whole. Want to see what happens if earnings fall 20% and take 5 years to "earn" them back?

Calculating... S&P Fair Value 3,015.

What if earnings drop 20% and only recover 75% of that ground by 2025?

Calculating... S&P Fair Value 2,860.

What is the market telling us about the economy?

You now have stocks pricing in a horrific picture going forward. Even if S&P 500 earnings fell 50% this hit took 5 years to rebound, fair value on the S&P today would be...2,903.

In the financial crisis, S&P earnings fell 75% but had recovered to 2007 levels by 2010 and record highs by 2013.

Mr. Market is now pricing in something worse than 2008. (Intrinsic value in this scenario is S&P 2,791. The S&P is currently at 2,458.)

* Don't just take our word for it. The "Godfather" of fundamental valuation, Aswath Damodaran (NYU Professor of Finance) voices comes to the same conclusion.

Now, is everything from here sunshine and roses? No. Do not rush in and deploy all the money you have. Make sure you have an emergency fund. Make sure you are psychologically willing to wait out this market for 2 years or more. Dollar-cost average. Be diversified.

One thing is clear: On a 5 or 10-year forward-looking basis, the market is already very cheap. So why not rush in and buy everything in sight? The answer: We have left the realm of mathematics and are now in the realm of psychology. Cheap can get cheaper. Panic begets more panic. Calling bottoms is impossible.

BUT for the person that starts a calculated

entry plan here, they are very likely to be rewarded for their presence of mind for years to come.

Please do not take this article as advice double or triple down on the market. Everyone's situation and risk tolerance is different and that will translate into different advice. This article is used for illustration purposes only. If you would like to be advised on using the information in this article to improve your situation, please call (920) 544-0576.

By Eric Sajdak, ChFC®

•

July 7, 2020

"If I delay my Social Security benefit, at what age would I breakeven versus simply filing at 62?" We field this type of question frequently from retirees. The Social Security system allows you to file anytime between 62 and age 70. At first glance, filing at 62 seems to make the most sense. After all, there are 12 months in a year and eight years between ages 62 and 70—That's 96 months of monthly paychecks that you wouldn't be getting if you delayed. However, you get penalized for taking your benefit early. Below is a diagram showing the penalties and delayed credits for someone whose Full Retirement Age is 66:

By Tony Hellenbrand

•

June 30, 2020

Lately I’ve been getting asked how I was able to “Call the Bottom” in late March. I want to make something clear: I didn’t. If you go back and look at the article from March 16th or read the email I sent out to subscribers on the 26th, (pure dumb luck), I ran a bad case, a best case, and a base case valuation on the S&P 500. I arrived at a base case valuation of 2,950, and at the time the S&P was hovering around 2,300, so we started recommending clients initiate buying plans. These plans did not mean “This is the bottom” or “Go all in.” Far from it. Many of our clients were buying several days before the precise bottom, and several days and weeks after. Regardless of how clearly I try to make this point (that we simply were buying something the math said was likely cheap) this morning my inbox is chock full of people asking what I think about valuations now. Are we in a bubble? Is the market ahead of the fundamentals? Are we going to double dip? Will the market crash? Will we need a second stimulus? Maybe. I have no idea. Here’s what I know, when you accumulate all of the available earnings estimates and make a conservative estimate of fair value, you end up with a fair value of about 3,060 on the S&P 500. As I type this we sit at 3,080. Regardless of whether the number is 2,950 or 3,060 or 3,080 or 3,150, any way you slice it, we’re at fair value, now. Analyst Earnings Estimates:

By Eric Sajdak

•

May 28, 2020

It is your right as an American to (legally) pay the least amount in taxes that you owe—nothing more, nothing less. But in recent years, Congress has made a concerted effort to shift the IRS code and levy you with taxes you didn't even know you were paying. We call these "Stealth Taxes." These changes are never talked about by your congressman (or woman). They lie deep within the tax code and can potentially cost you significantly unless you learn about how to avoid them. In this article, we cover three of those "Stealth Taxes" and what you can do to minimize or avoid them altogether.

Contact Our Team

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Safeguard Wealth Management relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Safeguard Wealth Management or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Safeguard Wealth Management is a Registered Investment Advisor with the SEC.