Blog Layout

The Forgotten Resolution: The 2020 Resolution Your Retirement Needs

Eric Sajdak • January 10, 2020

With the start of the new year, many of us reflect back on 2019 and look forward to the goals and resolutions we've made for 2020. While planning and writing down your resolutions for this year, don't miss the one in this post.

This resolution is one everyone can accomplish. It doesn't take a substantial commitment on your part. If fact, it's a one-time task.

When an investor or prospective client comes into our offices, we have a series of questions we ask to learn a bit more about their situation. One question that 9 out of 10 investors can't answer is:

"How much am I paying in fees for investing and advice?"

This question isn't meant to stump the investor. We aren't looking for an exact amount down to the penny. And yet, many struggle with this question.

And what's worse, when we do get a more definite answer, the answer is often significantly off of what they are actually paying. I don't blame the client.

The financial industry has done a magnificent job hiding fees in every nook and cranny they can find.

However, name another area of your life where this is acceptable. When you bought a home, you knew what you were buying the house for, what you spent upfront, what you're paying on an ongoing basis, etc. Yet, when it comes to the fees associated with our retirement savings...

So what's the "The Forgotten Resolution of 2020"?

Find out what you're paying in fees.

This article will help explain all the expenses you could be paying and what impact they are having on your future.

The reason this resolution is so important is that the vast amount of investors wildy underestimate their investment expenses. It is not uncommon for us to see investors paying 3-4 times what they think.

NOTE: I would be remiss without practicing what we preach. We believe the main reason clients don't understand their fees is because of a lack of transparency. To combat this trend, we put our pricing front and center on our website. You can learn more here.

The National Average For Fees

The most common answer we get is, "I'm paying 1% in investment-related fees."

And this is half true. Emphasis on

half...

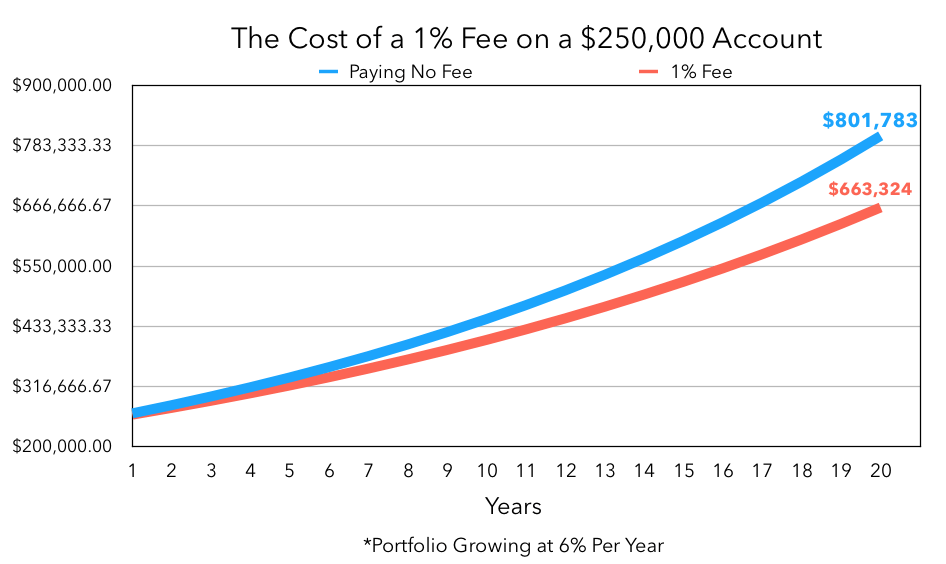

The "1%" fee we hear so often is because 1% is what the average advisor charges for their advice and services. Let's imagine this was the only fee you were paying, what impact does paying out 1% per year have on your retirement.

Was that more than you thought?

Now, don't get me wrong. An advisor who plans effectively and delivers what we call "Planning Alpha"; is worth their weight in gold. You are getting a bargain on paying that advisor 1%.

However, 1% to your advisor is hardly your only expense. Here are a few more you may not have thought of:

- Fund Expense Ratios - Fees that go to the mutual fund or ETF company you are invested in

- "Platform" Fees/Admin Fees

- Fees that go towards a platform your advisor is on and offering to you

- 12b-1 Fees

- "Distribution" Expense in addition to fund expense ratio

- Front Load Charges

- Upfront charge for buying into a mutual fund

- Deferred Sales Charges

- Back-end charge for exiting a mutual fund

- Transaction Costs

- Broker fees of buying and selling stocks and bonds

These don't even include hidden fees. Hidden fees will never show up on your statement. "Shedding Light on 'Invisible' Costs" a research paper written by PhDs Edelen, Evans, and Kaldec found hidden fees to be 1.44% on average.

NOTE: We will go more in-depth on hidden related fees in future articles, in this article we want to stay on expenses that are direct and easily calculated

I know what you're thinking. Just give me the damage report. How much more am I paying in fees?

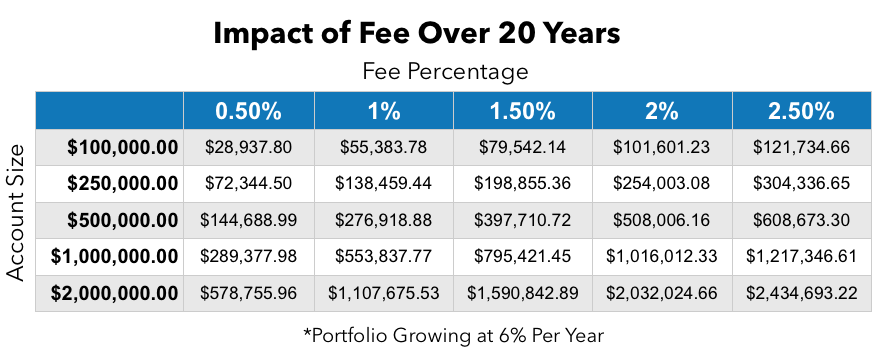

Well, according to Kitces.com, a leading advisor research shop and blog, the median client with a $1M portfolio is paying 1.75% as an all-in cost! Here is a chart from our pricing page.

What's more disturbing is a client with a $1M portfolio is likely being offered break-points (fee breaks due to the size of the account). If you're an investor with less than a $1M portfolio, you are likely paying more.

Does 1.75% come as a surprise to you? Maybe you brush it off as a cost of doing business. The average all-in cost means a lot of other investors are paying similar. I can't be getting hosed if everyone is paying that.

Not to pour salt into an open wound...

But the difference between our all-in fees compared to the national average make a difference of $613,270 in terminal value

for an investor looking over the next two decades.

The Importance of the Forgotten Resolution

Do you know your second largest expense in retirement?

On average... fees.

In the table below, find your nest egg size on the left. Find your fee level on the top. Let's run a simple calculator and see what fees will add up to over the next two decades if your investments grow by 6%/year.

After remembering the median all-in fee is 1.75%, the table above can be very sobering. This is a multiple hundred thousand dollar decision for many families.

The knee jerk reaction may be to think, "No advisor is worth any of those fees when I see how much they will add up to!". This would be a mistake in equal proportion to paying an advisor 2.5%.

What Am I Paying? Is It Too Much?

To accomplish this resolution, you need to be able to answer two questions:

- What am I paying for my investments and advice?

- Is that fee worth the investments and advice I am receiving?

The first question is tough to answer for many, but it shouldn't be. If you trust your advisor to give you an unbiased answer, take this article to them and ask them what you are paying for each of the fees listed above. If you'd rather have a third-party do a fee audit for you, we'd be happy to help.

Want Safeguard to perform a Fee Audit of your Retirement Accounts? Call (920) 544-0576 or fill out the form on our

Contact Us Page

The second question can be broken into two parts.

First, are the investments and advice worth it on a raw basis. If your advisor has built you a retirement plan, is giving you tax planning advice, has maximized your Social Security, etc. then he/she is likely worth the fee; if it is reasonable enough.

The second part in determining if your fee is worth it is reviewing alternatives.

Can you get the same or better advice for a less expensive fee? This might mean negotiating down your fees or switching advisors altogether.

- - - - - - - - - - - - - -

While making your goals and resolutions for the year, remember to check off the Forgotten Resolution. It may not be flashy. It's surely not as exciting as some of your other resolutions. But I promise, it will be one of the most impactful things you accomplish this year.

By Eric Sajdak, ChFC®

•

July 7, 2020

"If I delay my Social Security benefit, at what age would I breakeven versus simply filing at 62?" We field this type of question frequently from retirees. The Social Security system allows you to file anytime between 62 and age 70. At first glance, filing at 62 seems to make the most sense. After all, there are 12 months in a year and eight years between ages 62 and 70—That's 96 months of monthly paychecks that you wouldn't be getting if you delayed. However, you get penalized for taking your benefit early. Below is a diagram showing the penalties and delayed credits for someone whose Full Retirement Age is 66:

By Tony Hellenbrand

•

June 30, 2020

Lately I’ve been getting asked how I was able to “Call the Bottom” in late March. I want to make something clear: I didn’t. If you go back and look at the article from March 16th or read the email I sent out to subscribers on the 26th, (pure dumb luck), I ran a bad case, a best case, and a base case valuation on the S&P 500. I arrived at a base case valuation of 2,950, and at the time the S&P was hovering around 2,300, so we started recommending clients initiate buying plans. These plans did not mean “This is the bottom” or “Go all in.” Far from it. Many of our clients were buying several days before the precise bottom, and several days and weeks after. Regardless of how clearly I try to make this point (that we simply were buying something the math said was likely cheap) this morning my inbox is chock full of people asking what I think about valuations now. Are we in a bubble? Is the market ahead of the fundamentals? Are we going to double dip? Will the market crash? Will we need a second stimulus? Maybe. I have no idea. Here’s what I know, when you accumulate all of the available earnings estimates and make a conservative estimate of fair value, you end up with a fair value of about 3,060 on the S&P 500. As I type this we sit at 3,080. Regardless of whether the number is 2,950 or 3,060 or 3,080 or 3,150, any way you slice it, we’re at fair value, now. Analyst Earnings Estimates:

By Eric Sajdak

•

May 28, 2020

It is your right as an American to (legally) pay the least amount in taxes that you owe—nothing more, nothing less. But in recent years, Congress has made a concerted effort to shift the IRS code and levy you with taxes you didn't even know you were paying. We call these "Stealth Taxes." These changes are never talked about by your congressman (or woman). They lie deep within the tax code and can potentially cost you significantly unless you learn about how to avoid them. In this article, we cover three of those "Stealth Taxes" and what you can do to minimize or avoid them altogether.

Contact Our Team

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Safeguard Wealth Management relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Safeguard Wealth Management or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Safeguard Wealth Management is a Registered Investment Advisor with the SEC.